Own One of the Only Small Consumer Loan Franchise Businesses in the Country

With a flexible operating model and the potential for strong cash flow, there’s never been a better time to own a Keystone Financial Franchise.

ABOUT US

Discover Why KeyStone is a Standout Opportunity

We provide training, support, and systems built to help you compliantly run your own consumer loan business.

Proven Training & Support

From onboarding through opening day and beyond, you receive expert guidance from Franchise Consultants with real in-store experience and hands-on training built for your success.

Smart Systems

Our technology partnerships provide cost-effective, reliable loan systems so you can stay focused on running your business.

Flexible Ownership Model

Whether you're hands-on or managing from a distance, KeyStone gives you the tools and support to grow one location or expand to many.

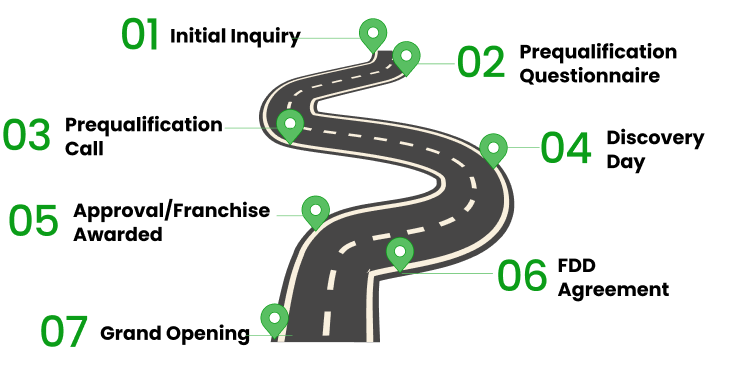

OUR PROCESS

Your Path to Franchise Ownership

The Investment

What You’ll Need to Get Started*

A lean, affordable model with recurring revenue, strong cash flow, and minimal overhead.

Franchise Fee

$50,000

Royalty Percentage

6%

Initial Investment

$408,400 - $714,500

Employees Needed

2 – 3 Employees

Hours open per week

45 Hour work weeks

Average Loan Size

$1539

Average Office Size

Office Size $1,237,254

Annual cash collected

$1,112,544

Annual Revenues

$751,300

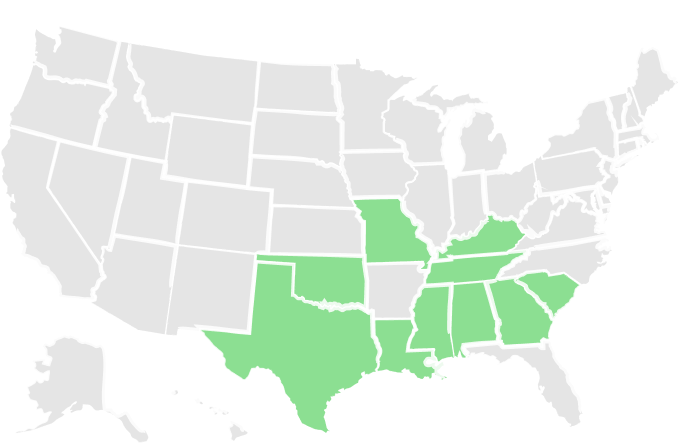

Available Territories

Where You Can Launch Your Franchise

With over 300 markets available across 10 states, our team will guide you in choosing an optimal location based on demographics, competition, and long-term growth potential.

The initial franchise fee is $50,000. There are many other costs that are associated with acquiring a suitable location, including staffing and proper funding. It is important to understand that the capitalization needed from a new franchisee can easily reach $1 million dollars. See the Franchise Disclosure Document for additional information.

KeyStone Franchising does not offer or guarantee financing to its franchisees. There are alternative funding options, and we will be glad to discuss those with you.

Yes. Advertising is completed through branch mail and/or website. We offer a vast array of creative and marketing products for our franchisees to use as part of the franchise marketing program. We get some of the highest response rates in the industry based on our creative pieces.

KeyStone can provide guidance on areas where a consumer loan offer would be viable. We will assist you in considering a variety of factors, including the demographics of the location, accessibility, competition, rent, construction costs, and where there are sufficient numbers of qualified customers from which to build a branch portfolio.

Other than the information contained in our Franchise Disclosure Document, KeyStone does not make revenue or profit forecasts for any prospective franchise location. Results are subject to far too many variables, such as market demographics, competition, the level of capitalization in the business, and the effectiveness of management in executing the business plan, to provide an accurate prognosis.

No! We actively seek qualified franchisees from a wide variety of backgrounds. Your ability to manage a team and keep them focused on the fundamentals of the consumer loan business is the greatest indicator of your potential success. We provide the training you need in the technical aspects of your small loan franchise and in using our proprietary lending and operational models. Your drive and the drive of your staff will determine the level of your success.

No. You have the flexibility to either run your branch or simply hire a manager and team to oversee. We do strongly recommend you fully understand how the operation works, but you do not need to work day-to-day. In addition, a small loan branch is generally open Monday – Friday 8:30 – a.m. 5:30 p.m. We are not an operation such as the food industry that involves 12-hour days, 7 days a week.

Consumer finance has been active in the US for over 100 years. Most consumer finance is done by large companies such as OneMain Financial, Regional Finance, First Franklin, World Finance, and several others. There has never been an opportunity for anyone to franchise a small loan location until now. KeyStone Financial has been in business since 2018, however, the founder and owner has been in the consumer finance business for the past 40 years. Working for some of the largest consumer finance companies in the industry, as mentioned above.

Lessons learned over the last forty years have allowed KeyStone to focus and deliver on exactly what consumer finance customers want. We offer a competitive array of products and superior customer service that includes customer-focused branches and even includes snacks for our customers. All in a small business atmosphere that doesn’t have the “corporate” feel.

On average, it takes between 3 – 6 months to open a KeyStone Franchise. Many factors influence the timing for the development of a branch. Your commitment to finding and developing a site is the main key to opening a branch quickly.

Your first step is completing our questionnaire to ensure you are a match for this business. The second step is making a trip to our corporate branch in Spartanburg, SC. This is a day for you to meet the senior management team, learn insightful information about the business and learn everything you can about this small loan business franchise. When you are approved as a franchisee, we will prepare franchise agreement documents. Once you sign a franchise agreement, we will help you through the steps of finding a location, gaining the knowledge to successfully operate your new business, and help you open your new branch.

Yes. You will need to apply and obtain a lending license through the state for which you will be lending. We will assist you with the process.

Any questions you have regarding how to start a KeyStone Financial branch, feel free to call:

Jody Anderson

Managing Member and Chief Executive Officer

227 East Blackstock Road, Suite 100

Spartanburg SC 29301

443-934-3066

JLAnderson@keystonefranchising.com