Our Values

Trust

No relationship can exist without it

Integrity

Without it, nothing else matters

Teamwork

We’re committed to each other’s success; not one is as strong as all of us

Honesty

Through holding ourselves and each other accountable

Respect

For each other and our customers

Transparency

Customers must always know their options and exactly what they are purchasing

The Investment

When you start a small loan franchise with KeyStone, you will need access to approximately $1,200,000 when your portfolio of receivables reaches maturity.

The initial franchise fee is $50,000. There are many other costs associated with acquiring a suitable location, hiring employees, and properly funding your business. It is important to understand that the capitalization needed for a new franchise can easily reach $1 million.

It is also important to note the KeyStone monthly royalty fee is 6% of monthly gross revenue after the first 3 months of operation.

KeyStone Financial does not directly provide, or guarantee, any financing to its franchisees. However, we do maintain some relationships with banks and lending institutions that are familiar with both the financing of small loans as well as our particular business model, and we are happy to make any introductions.

Other than the information contained in our Franchise Disclosure Document, KeyStone does not make revenue or profit forecasts when you start a small loan franchise with us. Results are subject to far too many variables such as market demographics, competition,

the level of capitalization in the business, and the effectiveness of management in executing the business plan to provide an accurate prognosis.

The Franchise Disclosure Document provides more detailed information regarding the fees, contractual relationships with Keystone Franchising, LLC., and the corporately-owned unit profit experience. Please refer to that information for a more detailed understanding of the franchise offering and business model.

Contact us today to learn how to buy a small loan franchise with KeyStone. We have all the tools, training, and resources needed to start a small loan franchise.

Investment goal

Let's Talk Numbers*

Franchise Fee

$50,000

Royalty Percentage

6%

Initial Investment

$408,400 - $714,500

Employees Needed

2.5 Employees

Hours open per week

45 Hour work weeks

Average Loan Size

$1539

Average Office Size

$1,237,000

Annual cash collected

$1,112,544

Annual Revenues

$751,310

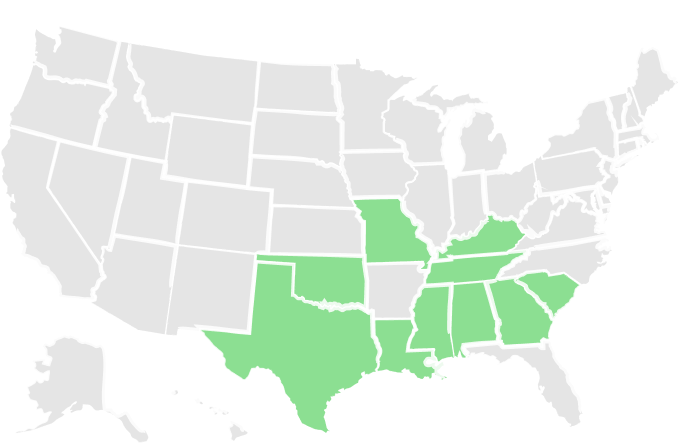

Available Markets

We have over 300 markets available across 10 states

We have over 300 markets available across 10 states

- Alabama

- Kentucky

- Georgia

- Oklahoma

- Louisiana

- South Carolina

- Mississippi

- Tennessee

- Missouri

- Texas